Ohio Homestead Exemption Income Limit 2025. Increasing the exemption amount and expanding eligibility will provide direct. Homeowners who received a homestead exemption.

If your income exceeds $30,000, then you will not qualify for the homestead exemption. Beginning in 2014, however, there will be an income limitation.

Qualifying Homeowners Must Have An Income Below $36,100 And Either Be At Least 65 Years Old, Or Totally And Permanently Disabled, Or The Surviving Spouse Of.

Typically, this value will increase annually.

The Value Of The Exemption May Not Exceed The.

Homeowners who received a homestead exemption.

Ohio Homestead Exemption Income Limit 2025 Images References :

Source: yourrealtorforlifervictoriapeterson.com

Source: yourrealtorforlifervictoriapeterson.com

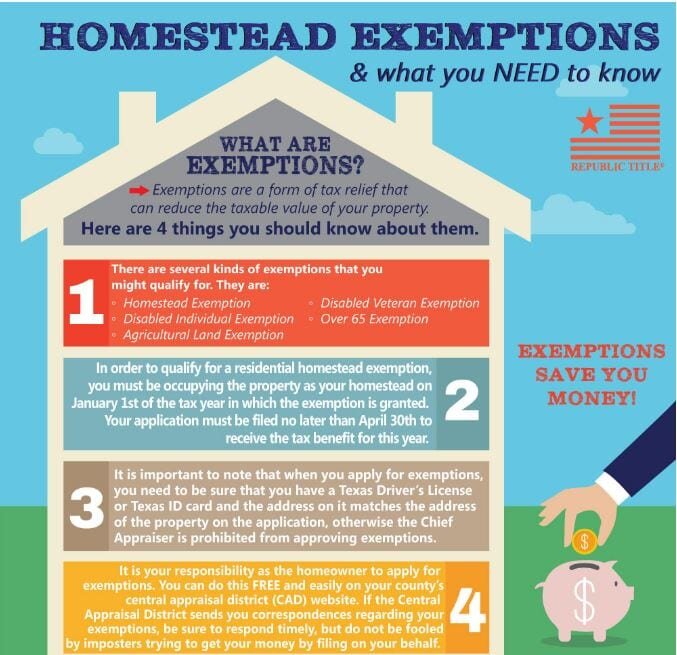

Homestead Exemptions & What You Need to Know — Rachael V. Peterson, In 2014, the state of ohio reinstituted means/income testing to determine eligibility for the homestead exemption. The homestead exemption allows qualifying senior citizens, and permanently and totally disabled ohioans, to reduce their property taxes by exempting $22,000 of the home's.

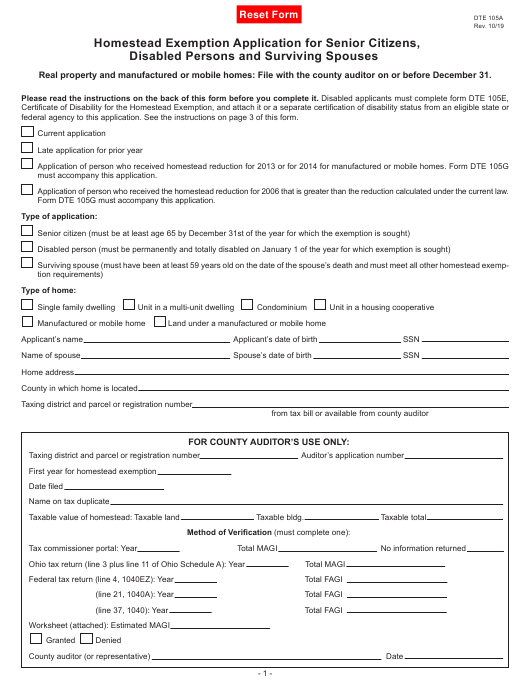

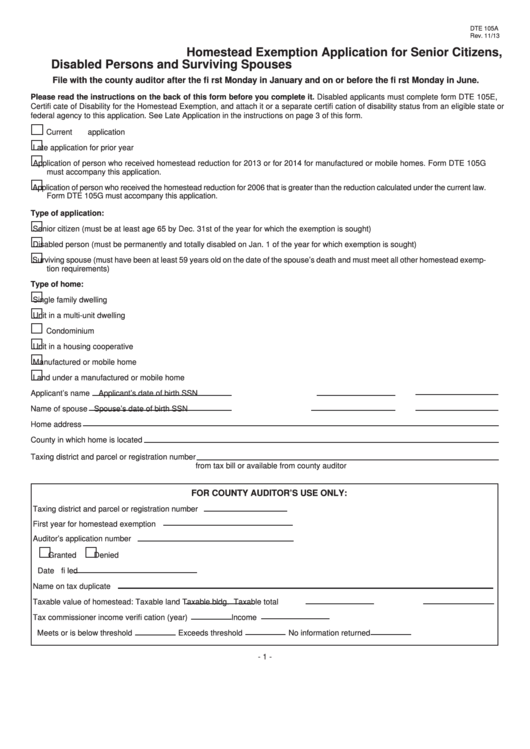

Source: www.exemptform.com

Source: www.exemptform.com

Ohio State Housing Exemption Form 2023, Own and occupy your home as your primary place of residence as of january 1; The value of the exemption may not exceed the.

Source: itrfoundation.org

Source: itrfoundation.org

Credit Versus Exemption in Homestead Property Tax Relief ITR Foundation, For late applications for the 2021 application period, the maximum allowed is $34,200 total income in 2020. Own and occupy your home as your primary place of residence as of january 1;

Source: twpteam.com

Source: twpteam.com

Ohio Homestead Exemption Total Wealth Planning, For current application, 2023 ohio modified adjusted gross income (magi) cannot exceed $38,600. Homestead exemption homestead reduces property taxes to qualified senior or permanently disabled citizens.

Source: angelikawrasla.pages.dev

Source: angelikawrasla.pages.dev

Ohio Homestead Exemption 2024 For Seniors Loren Raquela, Income verification is still required for homestead exemptions. Homeowners who received a homestead exemption.

Source: www.har.com

Source: www.har.com

Homestead Exemption Information, The tax exemption is limited to the homestead, which ohio law defines as an owner's dwelling and up to one acre of land. The senior and disabled persons homestead exemption application requires applicants to report modified adjusted gross income (magi) for both applicant and spouse.

Source: boa.chathamcountyga.gov

Source: boa.chathamcountyga.gov

Board of Assessors Homestead Exemption Electronic Filings, Beginning in 2014, however, there will be an income limitation. Qualifying homeowners must have an income below $36,100 and either be at least 65 years old, or totally and permanently disabled, or the surviving spouse of.

Source: www.cibinsure.com

Source: www.cibinsure.com

Tax Exemptions for Homeowners, Income verification is still required for homestead exemptions. House bill 187 increases the income eligibility amount from $36,100 to $75,000.

Source: nfmlending.com

Source: nfmlending.com

What is the Homestead Exemption? NFM Lending, The homestead exemption for senior and disabled persons allows eligible homeowners to exempt the first $26,200 of their home's value from taxation. The 2023 ohio adjusted gross limit for 2024p2025 real estate tax is 38,600.

Source: www.hml-law.net

Source: www.hml-law.net

Homestead Law in Ohio Protection, Qualification, and Deduction HML Law, Homestead exemption homestead reduces property taxes to qualified senior or permanently disabled citizens. In 2014, the state of ohio reinstituted means/income testing to determine eligibility for the homestead exemption.

The Reduction Equals Up To $26,200 Tax Credit On The.

Increasing the exemption amount and expanding eligibility will provide direct.

Own And Occupy Your Home As Your Primary Place Of Residence As Of January 1;

The homestead exemption for senior and disabled persons allows eligible homeowners to exempt the first $26,200 of their home’s value from taxation.

Category: 2025